DIFC's Regulator Enforces Global Standards.

DFSA Compliance, Meet Requirements or Forfeit Your DIFC License

Every financial services firm in DIFC must comply with DFSA regulations. The Dubai Financial Services Authority enforces through inspections, fines, and license withdrawal. Achieve compliance faster with DIFC-specific automation.

Achieve DFSA Compliance Fast

Obtain and maintain your DIFC authorization

DFSA regulates DIFC's entire financial ecosystem.

Dubai Financial Services Authority is the independent regulator of the Dubai International Financial Centre. DFSA authorizes and supervises all financial services firms operating in DIFC, banks, asset managers, investment advisers, insurers, fund managers, and more. DFSA sets prudential standards, conduct rules, AML/CTF requirements, and operational standards aligned with international best practices. DFSA conducts rigorous inspections, imposes substantial fines, and controls authorization to operate in one of the Middle East's premier financial centers. Firms treating DFSA compliance as tick-box exercise discover DFSA's enforcement is real, consequential, and can terminate your ability to conduct financial services business in Dubai's international financial hub.

DFSA supervision is intensive. Compliance doesn't have to be overwhelming.

Obtain Your DFSA Authorization

DFSA authorization requires comprehensive business plans, financial projections, governance frameworks, systems and controls, AML/CTF programs, and approved individual assessments. The authorization process is detailed and rigorous. Many applications face delays or refusal due to incomplete submissions or inadequate frameworks. Our platform guides you through DFSA requirements, generates required documentation, and dramatically improves authorization approval rates for DIFC financial services firms.

Complete applications. DIFC-specific documentation. Higher approval rates.

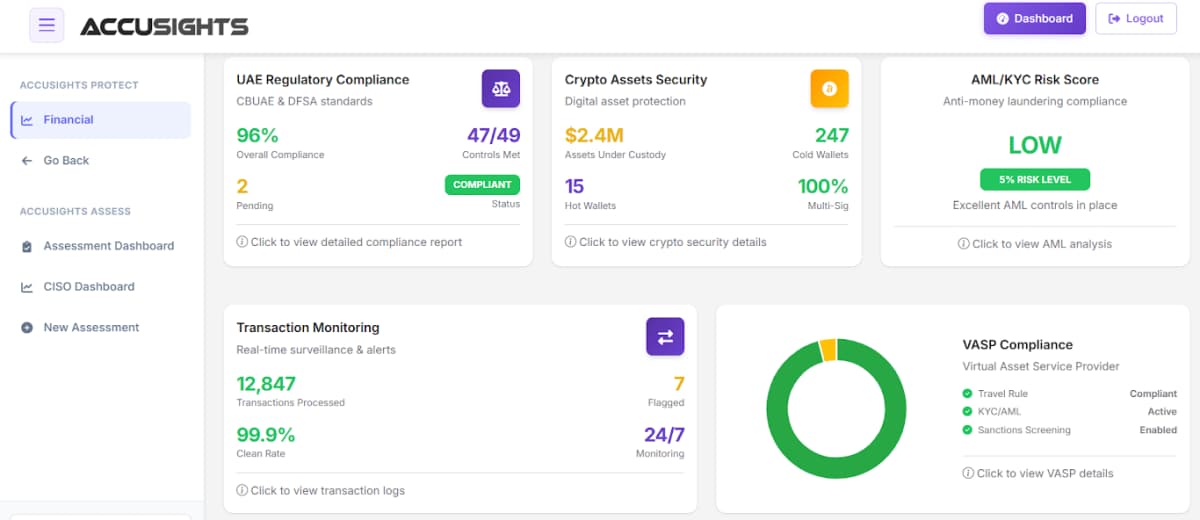

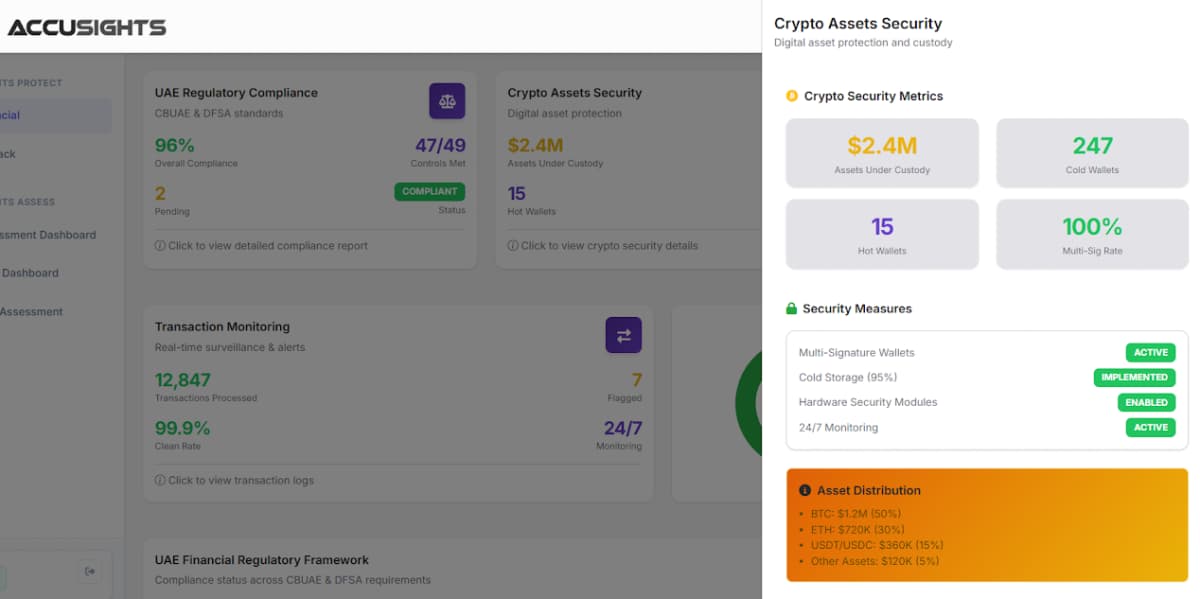

Implement Comprehensive AML/CTF Programs

DFSA enforces strict Anti-Money Laundering and Counter-Terrorist Financing requirements aligned with FATF standards and international best practices. You need customer due diligence, ongoing monitoring, sanctions screening, suspicious transaction reporting, and comprehensive AML/CTF policies. AML/CTF failures trigger immediate enforcement and threaten authorization. Our platform implements AML/CTF controls, automates screening and monitoring, and maintains the AML/CTF documentation DFSA supervisors demand.

Customer due diligence. Transaction monitoring. FATF alignment.

Meet DFSA Conduct of Business Standards

DFSA imposes detailed conduct of business rules governing client interactions, conflicts of interest, suitability assessments, client classification, disclosure requirements, and fair treatment. Conduct failures damage DIFC's reputation and trigger enforcement. Our platform implements conduct frameworks, manages client classifications, documents suitability assessments, and maintains the conduct documentation DFSA expects during supervisory visits.

Client classification. Suitability assessments. Fair treatment.

Maintain DFSA Prudential Standards

DFSA requires prudential standards ensuring financial soundness: capital adequacy, liquidity requirements, risk management, governance structures, and control functions. Prudential failures expose firms to financial instability and regulatory intervention. Our platform monitors capital and liquidity, implements risk frameworks, manages governance structures, and maintains the prudential documentation DFSA validates during authorization and ongoing supervision.

Capital adequacy. Risk management. Governance structures.

Submit Accurate Regulatory Returns

DFSA requires regular regulatory returns: prudential returns, conduct returns, AML/CTF reports, and material change notifications. Returns must be accurate, timely, and complete. Reporting failures trigger investigations and enforcement actions. Our platform automates regulatory reporting, tracks deadlines, validates submissions, and maintains the reporting records DFSA reviews during supervisory activities.

Automated reporting. Deadline tracking. Accurate submissions.

Prepare for DFSA Supervisory Visits

DFSA conducts regular supervisory visits examining authorization compliance, AML/CTF programs, conduct standards, prudential requirements, systems and controls, and regulatory reporting. When DFSA arrives, they expect immediate access to policies, procedures, records, and evidence of compliance. Our platform maintains visit-ready documentation, turning DFSA supervision from authorization threats into routine regulatory oversight.

Always visit-ready. Immediate documentation access. Sustained authorization.

Why Financial Firms Choose This Path

From planning to DFSA-authorized firm.

Firms using our platform:

Get Authorized Faster

Complete application packages, DIFC-specific documentation, and guided processes cut DFSA authorization timelines dramatically.

Pass DFSA Visits

Comprehensive documentation and implemented controls mean DFSA supervisory visits become routine oversight instead of crises.

Implement AML/CTF

Automated AML/CTF compliance ensures customer due diligence, transaction monitoring, and FATF-aligned controls.

Meet Conduct Standards

Conduct frameworks and client management ensure DIFC firms meet DFSA's demanding conduct of business requirements.

Maintain Authorization

Ongoing compliance monitoring and regulatory reporting protect your DFSA authorization, preventing enforcement actions.

Build Regional Presence

DIFC authorization demonstrates international standards and regulatory compliance, building credibility across Middle East markets.

Built for DIFC. Proven with DFSA. Trusted by Financial Services Firms.

Meet Every DFSA Regulatory Requirement

DFSA's requirements are comprehensive. Our platform covers every obligation.

DFSA imposes extensive requirements on DIFC authorized firms covering authorization, prudential standards, conduct of business, AML/CTF, governance, systems and controls, and regulatory reporting. Our platform systematically addresses every requirement, maintains required evidence, and keeps you ready for DFSA supervision.

Complete requirements. Systematic compliance. DFSA-ready documentation.

DFSA Regulatory Requirements

Comprehensive coverage for DIFC financial services